Life Insurance in and around Franklin

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

When facing the loss of your spouse or your partner, grief can be overwhelming. Regular day-to-day life halts as you prepare for funeral services arrange for burial, and face life without the one you love.

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Love Well With Life Insurance

Having the right life insurance coverage can help loss be a bit less stressful for those closest to you and allow time to grieve. It can also help cover bills and other expenses like future savings, home repair costs and utility bills.

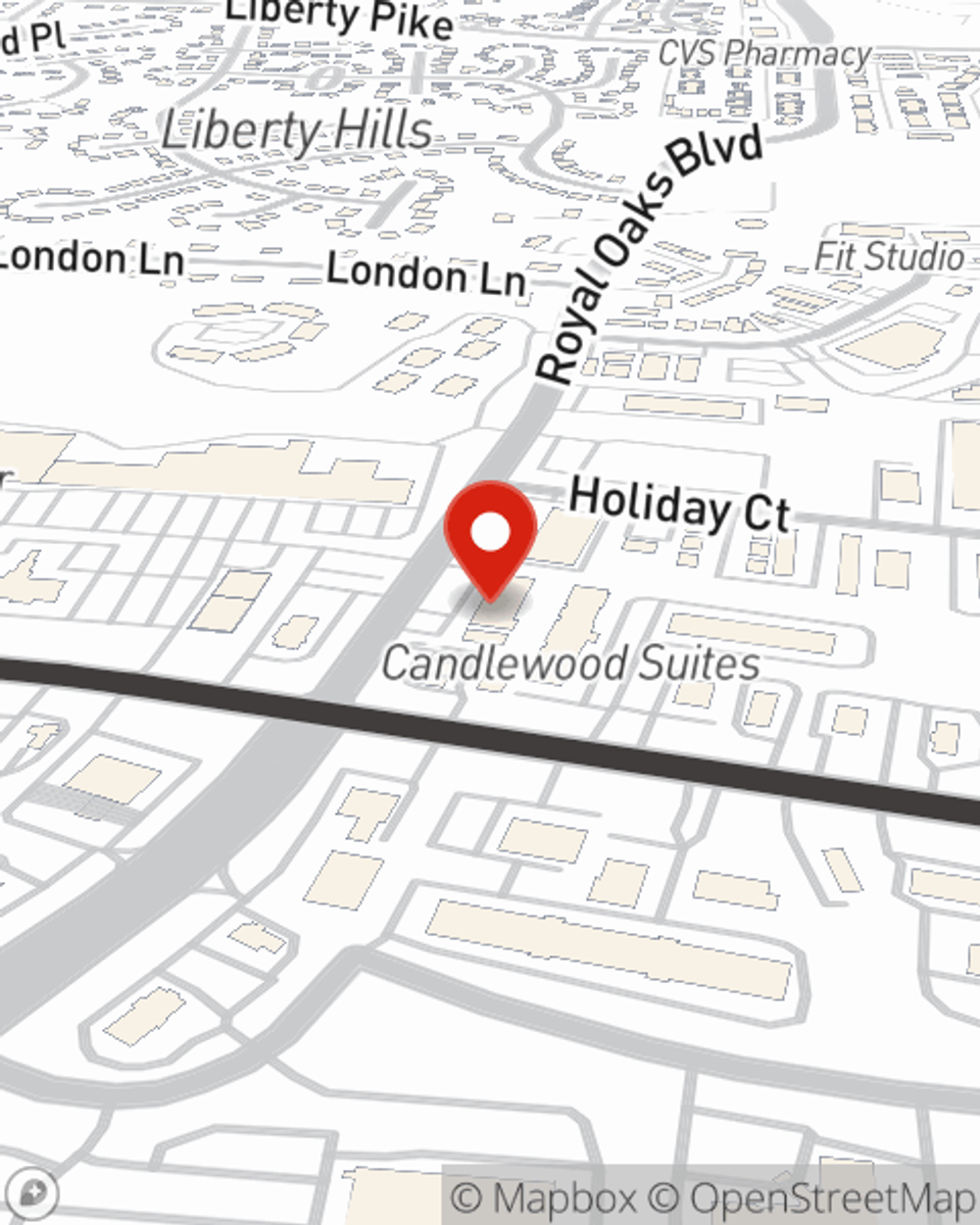

When you and your family are insured by State Farm, you might rest assured that even if something bad does happen, your loved ones may be protected. Call or go online today and discover how State Farm agent Anita Hendrix can help meet your life insurance needs.

Have More Questions About Life Insurance?

Call Anita at (615) 794-4646 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.

Anita Hendrix

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.